Table of Contents

- Catch-Up Contributions Into a Roth 401(k) Isn't a Bad Idea | Kiplinger

- Older workers can contribute more to their 401(k)s in 2025: Here's why

- Maxing Out 401(k) & Roth IRA Plans | Limits, Benefits & What Is Next

- Catch-Up Contributions Into a Roth 401(k) Isn't a Bad Idea | Kiplinger

- Catch-Up Contributions Into a Roth 401(k) Isn't a Bad Idea | Kiplinger

- Retirement plans are changing in 2025: What to know - ABC News

- Here’s how much 401(k) contribution limits are likely to rise next year ...

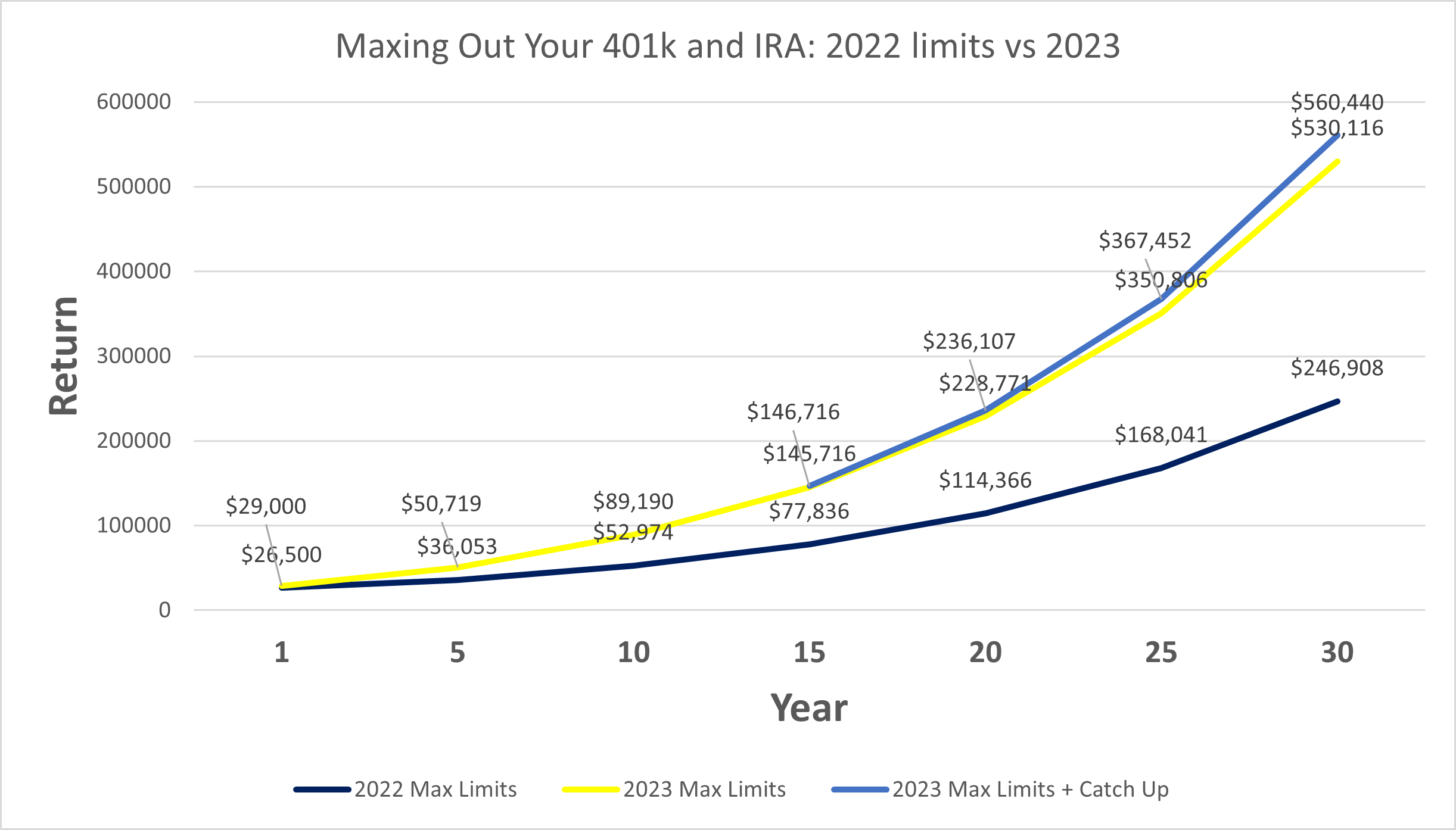

- New 401(k) and IRA Limits Could Equal an Additional 300k in Your Pocket ...

- 1 Major 401(k) Contribution-Limit Change Coming in 2025

- IRA And 401(k) Contribution Limits Are Increasing. That’s Great News If ...

What is a Roth 401(k)?

Roth 401(k) Contribution Limits for 2023

_and_Roth_IRA_Plans.png?width=1920&name=Things_to_Consider_Before_Maxing_Out_401(k)_and_Roth_IRA_Plans.png)

Roth 401(k) Contribution Limits for 2024

The Roth 401(k) contribution limit for 2024 is expected to be $23,000, although this is subject to change based on inflation adjustments. The catch-up contribution limit for those 50 and older is expected to remain at $7,500.

Roth 401(k) Contribution Limits for 2025

While the official limits for 2025 have not been announced, we can expect another increase based on inflation adjustments. It's essential to stay informed and check for updates from the IRS to confirm the 2025 Roth 401(k) contribution limits.

Key Considerations and Tips

When planning your Roth 401(k) contributions, keep the following tips in mind: Contribute as much as possible: Take advantage of the annual contribution limits to maximize your retirement savings. Automate your contributions: Set up automatic transfers from your paycheck to make saving easier and less prone to being neglected. Consider catch-up contributions: If you're 50 or older, don't miss out on the opportunity to contribute extra funds to your Roth 401(k). Monitor and adjust: Keep an eye on changes to contribution limits and adjust your strategy accordingly to ensure you're making the most of your retirement savings. Staying informed about Roth 401(k) contribution limits is crucial to maximizing your retirement savings. By understanding the limits for 2023, 2024, and 2025, you can create a robust retirement plan and make the most of your hard-earned money. Remember to contribute as much as possible, automate your contributions, and take advantage of catch-up contributions if eligible. With a solid understanding of Roth 401(k) contribution limits, you'll be well on your way to securing a comfortable and financially stable retirement.For more information and updates on retirement savings, visit our website and follow us on social media. Stay ahead of the curve and make informed decisions about your financial future.